Category: News

Accueil » News

WHITE PAPER : INVESTMENT AND SHAREHOLDING, LEVERS OF THE ECONOMIC SUCCESS OF WOMEN

In March 2020, during the 3rd edition of WinDay, the women’s investment forum, Femmes Business Angels wrote a white paper on the theme of investment and shareholding, levers of economic success for women. One year later, find our English version, an opportunity for us to go beyond borders.

In its white paper, FBA makes three observations:

Many speeches and actions aim to promote the place of women in the economy, but women’s investment and shareholding are forgotten, even though they have tremendous leverage effects for the economy.

There are few, if any, studies on the subject of women’s shareholding. Women are largely under-represented in the sphere of shareholding and investment due to cultural, educational, family and financial obstacles.

However, women are a formidable lever for boosting the entrepreneurial value chain and providing new essential resources for the development of a more sustainable, more inclusive and fairer economy.

FBA conducted some 20 hearings with economic players and drew on its proximity to male and female entrepreneurs, its proven practice of co-investment with public and private investment funds, its collaboration with participatory financing platforms and its long experience in training women on the subjects of investment and entrepreneurship to formulate 4 courses of action:

o Collect data on women’s shareholding and create a women’s shareholding index under the guidance of a multidisciplinary committee.

o Mobilize and support women shareholders by developing training in shareholding and investment, following the example of the investment master classes created by FBA.

o Better direct public funds to the most inclusive companies.

o Support private investment by improving the tax incentive of the Madelin scheme for investments made in companies that respect impact, gender and diversity criteria.

Accueil » News

What's happened to angel investing in Europe during Covid-19 ?

Venture capital investment into European startups is slowing down. VCs are still making investments — and telling everyone who will listen on Twitter that this is the case — but fewer, and for less capital, than before. Funding rounds in Europe dropped by 22% in March, according to Dealroom, and valuations are down by 10-40%. But what’s going on with the somewhat less vocal angel investors? Have they closed their cheque books — or are they seizing the opportunity to get in on some good deals?

“We’ve seen some decrease in investing, but it has not been terrible,” says Luigi Amati, president of Business Angels Europe, which represents more than 40,000 angels across Europe. Some angels, like VCs, are focusing on helping out existing their portfolio rather than looking for new investments; some ‘tourist’ angels have disappeared; but many more are actively investing.

It matters where angels are based: startup and investor support measures vary between countries, with some more angel-friendly than others. As a result, some angel groups are as active as they were before the crisis, and seeing increased deal flow even as others — notably in the UK — have seen many angels fly the nest.

The angels who haven’t vanished are spending more time looking at investments

Business angel clubs are reporting higher than usual attendance at pitch events, now that they’re taking place online.

“Paradoxically, members are more available. We’ve had two monthly meetings now where startups pitch via Zoom, and attendance is significantly higher than in the usual pitch plus cocktail format,” says Elizabeth Pauchet, member of FBA (Femmes Business Angels).

“We witness quite some enthusiasm for our monthly startup pitches, which we organise online for the moment,” says Munck at Be Angels. “We have much more participation than at our physical events.”

Angels are also moving quickly, in some cases. “Due diligence and deal execution are quicker; many people have been able to carve out more time to focus on their business angel activity (which is a side interest for the vast majority of our network’s members),” says Elizabeth Pauchet.

By Amy Lewin, “What’s happened to angel investing in Europe during Covid-19 ?”, Sifted, Thursday 21 May 2020

Accueil » News

WINDAY 2020 : THE WOMEN INVESTMENT FORUM

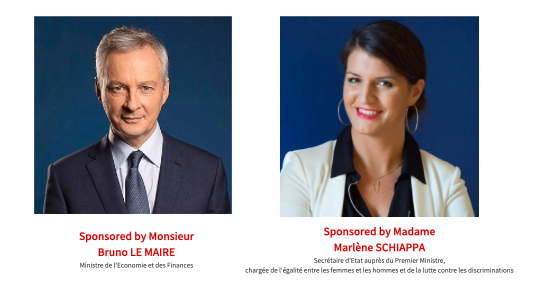

The 3rd edition of the Women's Investment Forum was held on March 3, 2020 at Bercy

Femmes Business Angels organised the 3rd Winday, a women’s investment forum, on 3 March 2020 with the support of BNP Paribas Private Bank. The forum was held at the Ministry of Economy and Finance.

Numerous speeches and actions were aimed at promoting the place of women in the economy. Nowadays women are at heart of many public and private policy projects : entrepreneurship and access to financing, careers in technology and digital, quotas in executive committees. Incubators and accelerators have multiplied in french regions to encourage female entrepreneurship. Financial institutions, banks, insurance companies, asset managers and private equity funds are recruiting more female coworkers and projects leaders.

However women’s investment and shareholding are forgotten. Women’s private money management is an intimate matter and still faces many cultural barriers. The subject is regarded as technical, even a little taboo, and it is rarely talked about. Women are not encouraged to become actors in this field.

Indeed, women can play an important role in creating and preserving value in the economic chain, whether as investors in start-ups, shareholders in listed or unlisted companies, directors or operational managers of small and large companies that they have created or taken over as major shareholders.

Women Business Angels are one example. At the heart of innovative challenges, they invest with a taste for risk and success without fear of failure in all sectors of the economy. By giving an important place to gender diversity in their investment criteria, they actively support female entrepreneurship but above all women’s investment. The third edition of the WINDAY forum encourages women to become actors of their personal financial autonomy and to invest in the productive economy, as shareholders.

Accueil » News

To know more about our Femmes Business Angels network and its news, access the French version of the site or contact us on our email address :

contact@femmesbusinessangels.org

Thanks for your visit !

Accueil » News

WINDAY 2018 : EUROPEAN WOMEN ANGEL INVESTMENT FORUM

We are pleased to invite you to the first European Women Angel Investment Forum on November 15, 2018.

Meet the leading women angels and networks from around Europe that work to stimulate female investment. On November 15, Business Angels Europe organizes two intensive workshops for the WA4E partners and their women angels. Panelists from different European countries will dive into the motivation, incentives and inspiration of women angels.

In the evening, at the ministry of Digital Affairs in Paris, Femmes Business Angels opens their Winday event to Europe. In two round-tables with the leading voices from French and European Women Angels, we explore the challenges, inspiration and journey ahead.